The Grayscale Bitcoin Miners ETF will list global BTC mining companies with a semi-annual distribution frequency.

The Bitcoin mining industry is contesting for the remaining around 1 million BTCs thus attracting more institutional investors.

, a leading digital asset management company backed by Digital Currency Group, has announced the launch of a new investment vehicle dubbed Grayscale Bitcoin Miners ETF (NYSE Arca: MNRS). Launched on January 30, 2025, the Grayscale Bitcoin Miners ETF (MNRS) offers investors an opportunity to gain exposure to a global basket of publicly traded BTC mining companies.

As a result, investors seeking to gain indirect exposure to Bitcoin’s volatility can tap into the Grayscale Bitcoin Miners ETF to strengthen the BTC network. Moreover, the Bitcoin mining industry is critical to securing the integrity of the $2 trillion flagship asset.

“Grayscale Bitcoin Miners ETF offers investors targeted exposure to Bitcoin Miners and the global Bitcoin mining industry in a passively managed, rule-based, and index-tracked fund designed to evolve with the industry. Bitcoin Miners are well-positioned for significant growth as Bitcoin adoption and usage increases, making MNRS an appealing option for a diverse range of investors,” David Lavaalle, Global Head of ETFs at Grayscale, .

With a distribution frequency of semi-annual, the MNRS will not invest directly in digital assets or any initial coin offering. Foreside Fund Services will be mandated to distribute the MNRS whilst Grayscale Advisors acts as the fund’s advisor.

What to Expect from the Grayscale Bitcoin Miners ETF

The mainstream adoption of digital assets and web3 protocols by institutional investors and now nation-states has helped crypto-related companies grow in tandem. As of this writing, the largest Bitcoin mining companies around the world, which are likely to be listed in the Grayscale Bitcoin Miners ETF, had a combined market capitalization of about $32 billion.

In the United States, the largest Bitcoin mining companies include Marathon Digital Holdings with a valuation of about $6.25 billion, followed by Riot Blockchain and Core Scientific with a valuation of about $3.85 billion and $3.2 billion respectively.

Other unicorns in the US Bitcoin mining industry include CleanSpark, TeraWulf, and Cipher Mining with a total valuation of about $2.8 billion, $1.8 billion, and $1.56 billion respectively, as of this writing.

In the United Arab Emirates, Phoenix Group is the largest Bitcoin miner with a total valuation of about $2 billion. In Singapore, Bitdeer Technologies Group is the largest BTC miner with a net valuation of about $3.3B at the time of this writing.

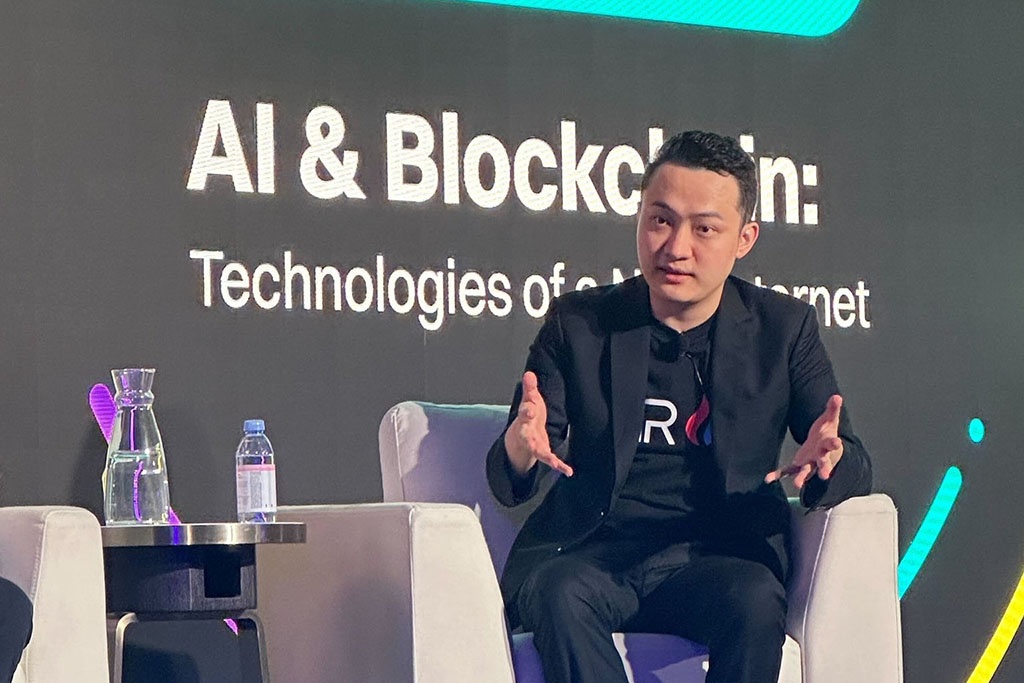

In Canada, Hut 8 Mining is the largest BTC miner with a valuation of about $1.8 billion, which is likely to be included in the Grayscale Bitcoin Miners ETF. In Australia, the largest BTC miner likely to be listed in the MNRS ETF is IREN (Iris Energy), which currently has a total valuation of about $2.13 billion.