The SEC has approved Bitwise’s Bitcoin and Ethereum ETF, fast-tracking the process due to its similarity to prior spot crypto ETFs.

The approval follows recent leadership change at the SEC.

January saw a flood of crypto ETF filings, including memecoin and Solana-focused products.

The US Securities and Exchange Commission () has approved a 19b-4 filing from the New York Stock Exchange (NYSE) to list and trade shares of Bitwise’s joint Bitcoin and Ethereum exchange-traded funds (ETFs).

According to the SEC, the approval process was expedited due to the ETF’s structural similarities to previously approved spot crypto ETFs. The agency confirmed that the filing met regulatory standards, allowing for a faster review.

Regulatory Approval and Compliance

The SEC that the ETF aligns with securities laws, particularly Section 6(b)(5) of the Exchange Act, which mandates that exchange rules be designed to prevent fraud and protect investors.

“In particular, the Commission finds that the proposal is consistent with Section 6(b)(5) of the Exchange Act, which requires, among other things, that the exchange’s rules be designed to ‘prevent fraudulent and manipulative acts and practices’ and, in general, to protect investors and the public interest,” the SEC noted in its statement.

While the industry awaits the final approval of Form S-1, this latest decision marks the second joint crypto ETF greenlighted by the SEC in recent weeks.

In December 2024, the regulator approved a similar ETF filed by Hashdex and Franklin Templeton. At the time, the agency stated that both the Hashdex Nasdaq Crypto Index US ETF and the Franklin Crypto Index ETF would initially hold spot Bitcoin and Ethereum based on market capitalization, with potential expansions to other cryptocurrencies.

Unlike those investment products, which were speculated to launch in January by Bloomberg analyst Eric Balchunas, Bitwise’s combined Bitcoin and Ethereum ETF will remain limited to the two leading digital assets, with no plans to add additional cryptocurrencies.

The ETF will calculate the market capitalization of Bitcoin and Ethereum by multiplying pricing benchmarks by their respective circulating supplies. Currently, Bitcoin and Ethereum have market capitalizations of $2.7 trillion and $394 billion, respectively, according to from CoinMarketCap.

The fund will be managed by Bitwise Investment Advisers, with Coinbase serving as the custodian for digital assets. Additionally, Bank of New York Mellon has been selected to act as the cash custodian, administrator, and transfer agent for the product.

Surge in Crypto ETF Filings

The approval comes amid a wave of crypto ETF applications submitted in early 2025. On January 28, Bitwise filed for a new ETF focused on meme coins, including Dogecoin (DOGE).

Meanwhile, Cboe has submitted filings to list and trade Solana (SOL) ETFs from asset managers such as VanEck, Canary, Bitwise, and 21Shares. Additionally, on January 30, Coinbase Derivatives filed for new futures contracts on Solana and Hedera tokens.

Following the submissions, Bloomberg ETF analyst James Seyffart noted that ETF issuers are “testing the limits of what this SEC is going to allow,” referencing a recent by Tuttle Capital for ten leveraged crypto ETFs.

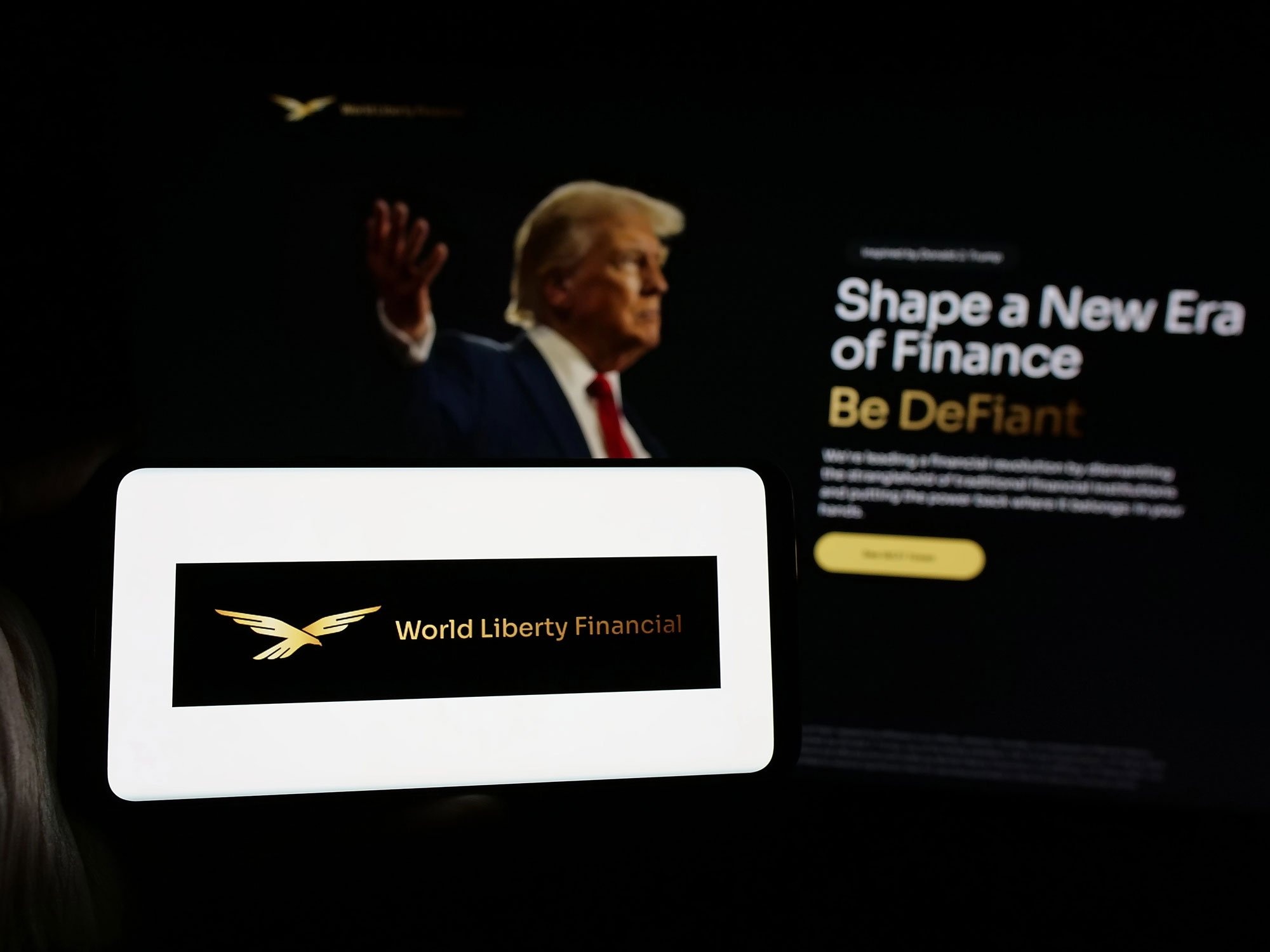

Meanwhile, the SEC’s shifting stance on crypto ETFs comes amid leadership changes following Donald Trump’s return to the White House. SEC Chair Gary Gensler in January after Trump’s inauguration, leading to the appointment of Mark T. Uyeda as acting chair.

Uyeda’s temporary leadership could indicate a more lenient regulatory approach toward the industry under the second Trump administration. Paul Atkins, a former SEC commissioner known for his pro-business and deregulatory stance, is expected to be confirmed as the agency’s permanent chair in the coming months.